Senate GOP gains votes from Corker, Rubio, improving chances of final tax agreement

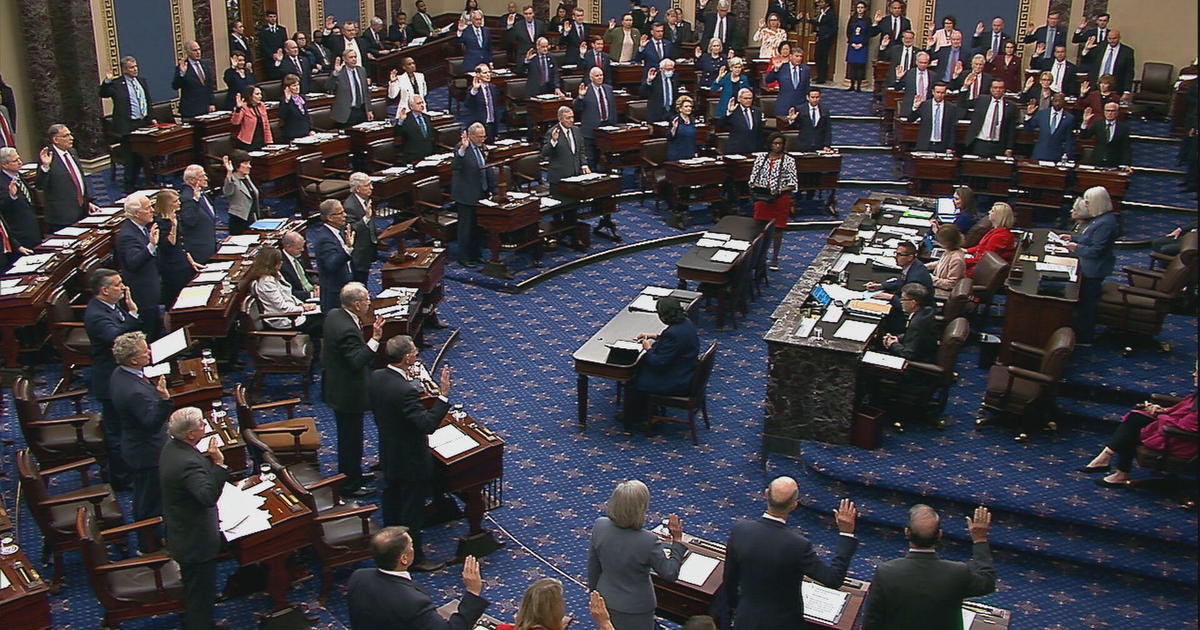

Senate Republicans gained more definitive "yes" votes for a final tax overhaul agreement on Friday, as the GOP released its conference-negotiated deal. Republicans aim to hold floor votes in the House and Senate next week, with the vote in the House taking place first on Tuesday.

Some senators who had been on the fence made up their minds on Friday.

Sen. Marco Rubio, R-Florida, was back on board Friday after earlier telling Senate leaders that he planned to vote against the package unless the child tax credit was further expanded. The tax credit is worth $2,000, but in the original bill, poorer families who do not owe federal income taxes would only be able to claim up to $1,100. At Rubio's and Utah Sen. Mike' Lee's insistence, tax negotiators increased the refundability of the tax credit to $1,400, a move that Rubio welcomed.

"For far too long, Washington has ignored and left behind the American working class," Rubio said in a statement officially announcing his "yes" vote. "Increasing the refundability of the child tax credit from 55 percent to 70 percent is a solid step toward broader reforms which are both pro-growth and pro-worker. But there is still much more to do in the months and years to come. The progress made on the child tax credit would not have been possible without the support of Senators Mike Lee and Tim Scott, and Ivanka Trump."

When the Senate voted on the tax bill earlier this month, Rubio and Utah's Sen. Mike Lee offered an amendment making the credit more fully refundable, a change they would pay for by bumping up the proposed corporate tax rate from 20 percent to 21 percent. It was rejected. Rubio and Lee still supported the bill, likely with the thought that they would have another chance to push for their measure in conference. Tax negotiators earlier this week agreed to bump up the corporate rate to 21 percent so that tax rates could be lowered for the wealthiest Americans. Rubio, on Tuesday responded on Twitter, "20.94% Corp. rate to pay for tax cut for working family making $40k was antibrowth but 21% to cut tax for couples making $1 million is fine?" He criticized the conference committee again Thursday. By Friday, the tax conference committee expanded the tax credit.

Republicans can only afford two defections in the Senate, assuming all Democrats oppose the legislation. Passage requires only a simple majority vote, and Republicans could still need to rely on Vice President Mike Pence to break a tie.

Sen. Bob Corker, R-Tennessee, who recently voted against the Senate GOP's initial version, indicated Friday afternoon that he is a yes. It's unclear if anything in the agreement changed to ease Corker's mind over fiscal concerns, which had held him back from signing onto the agreement earlier.

"After many conversations over the past several days with individuals from both sides of the aisle across Tennessee and around the country—including business owners, farmers, chambers of commerce and economic development leaders—I have decided to support the tax reform package we will vote on next week," Corker said in a statement.

"This bill is far from perfect, and left to my own accord, we would have reached bipartisan consensus on legislation that avoided any chance of adding to the deficit and far less would have been done on the individual side with items that do not generate economic growth.

"But after great thought and consideration, I believe that this once-in-a-generation opportunity to make U.S. businesses domestically more productive and internationally more competitive is one we should not miss."

Sen. Mike Lee, R-Utah, remains undecided, according to his communications director, Conn Carroll.

"Sen. Lee is undecided on the bill in its current form. Sen. Lee continues to work to make the [child tax credit] as beneficial as possible to American working families."

The bill would eliminate Obamacare's health insurance mandate, double the standard deduction for individuals and married couples, and allow taxpayers to deduct a combined $10,000 from state and local income taxes and property taxes. It would also lower individual tax rates, bringing the top rate down from 39.6 percent to 37 percent, senior congressional aides told CBS News on Wednesday.

Meanwhile, Sen. John McCain, R-Arizona, who's been battling an aggressive form of brain cancer, remains hospitalized at Walter Reed Medical Center for "normal side effects" of his treatment from brain cancer, his office said. It's unclear when he will be released.

Sen. Thad Cochran, R-Mississippi, has also been absent and hasn't voted since Dec. 7. Cochran had an outpatient procedure done Monday to address a non-melanoma lesion on his nose, a spokesman told CBS, who added that the senator is in Washington and expects to vote for the tax plan in the Senate next week.

CBS News' John Nolen, Rebecca Shabad and Kathryn Watson contributed to this report.