This rebound could keep its bounce

Stocks are powering higher again, with the Dow Jones industrial average regaining its key 200-day moving average -- a measure of medium-term trend -- and closing back in on the 17,000 level it first bagged in July. The tech-heavy Nasdaq Composite has been even stronger as is on the verge of retaking its 50-day moving average after bouncing nearly 9 percent off of its lows last week.

On Thursday, the Standard & Poor's 500 index rose 23.71 points, or 1.2 percent, to close at 1,950.82. The Dow climbed 216.58 points, or 1.3 percent, ending at 16,677.90. The Nasdaq composite rose 69.95 points, or 1.6 percent, to finish at 4,452.79.

Those moves just go to show how powerful the market rebound has been as the pendulum of emotion has been slammed from fear back to greed. I mean really slammed.

And right now, the evidence suggests the rebound will continue.

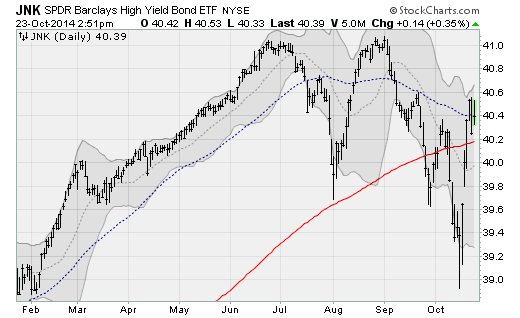

A number of catalysts have been in play, but the most substantive being a calming of the Ebola situation in the U.S. Within the market, we've seen the bond turmoil that was largely responsible for the sell-off (such as the Oct. 15 panic buying of Treasury bonds) diminish as traders have moved back into high-yield corporate bonds.

The chart below shows just how choppy trading in these junk bonds has become. But we're going up, so stocks are being dragged higher.

This has a lot to do with the Federal Reserve and fears over the market impact of the QE3 bond-purchase stimulus program ending later this month. The Fed's policy statement next Wednesday will likely confirm that given the improvement in the economy and the job market (unemployment rate at 5.9 percent amid the best pace of job gains since the dot-com bubble) the bond buying will end. That will leave the market without the steady drip-drip support of Fed purchases for the first time since 2012.

The realization that this was coming caused a lot of indigestion in the bond market heading into last week's market drop.

In response, cognizant of how sensitive this market is to any shifts in the outlook for cheap money stimulus, Fed officials were out in force over the past week reassuring investors that any slowdown in the U.S. economy would either result in more Fed bond-buying and/or the holding of short-term interest rates near zero percent for longer.

These reassuring words -- which economists dub "verbal easing" -- have apparently done the trick. The bond market calmed. Junk bonds rebounded. And stocks soared.

Other factors have been in play as well, such as the European Central Bank being set to unleash new stimulus of its own. Also helping is the realization that recent market turmoil will actually boost the economy via lower crude oil prices and lower long-term interest rates, a consequence of investors abandoning commodities and seeking the safety of U.S. Treasury bonds. The U.S. 10-year yield tested down below 2 percent last week, from a high of more than 3 percent in late 2013. And crude oil fell to $79 a barrel last week, from a high of nearly $108 in June.

As a result, some indications say a short-term uptrend is underway. My preferred breadth measure -- the percentage of S&P 500 stocks in uptrends -- flashed its first buy signal since August. That suggests this uptrend could have some legs into November as a growing share of the market participates to the upside.

This is a sign of broad and robust buying demand as investors find a wide swath of the market is attractively priced at these levels.

Moreover, it's worth remembering as we head into next week's Fed policy statement, which will cover the future of QE3, that big Fed policy events -- be they announcements, minute releases, speeches, etc. -- almost always result in big surges for the market because Fed officials find a way to give traders exactly what they want to hear.

After last week's harrowing decline, the Fed's more dovish members, who represent the majority of the committee for now, came out in force to talk up both the potential for holding short-term rates lower for longer and for potentially extending or restarting the bond-buying stimulus.

I find it hard to believe that at this critical moment, with QE3 ending, the Fed will drop the ball. Look for a long statement emphasizing downside risks and the problems a strong dollar could cause.

We've also seen some good quarterly earnings reports from the likes of Yahoo (YHOO) and Caterpillar (CAT).

And finally, the U.S. economic data remains strong. Inflation is low, and oil prices are coming down hard, bolstering consumers and setting the stage for a breakout in retail stocks for the first time in a year. Wholesale gasoline futures are down to 2010 levels.

The bond market freakout of late has pushed down yields, reigniting mortgage refinancings that will also help consumers by lowering monthly payments.

Assuming the Fed's policy statement goes smoothly, the market should be in the clear until early November. That's when investors will need to react to the odds that the GOP retakes the Senate in the midterm elections, potentially setting the stage for more budget battles in Washington.

But for now, things are looking up.